“What’s the difference between a hero and a coward? There ain’t no difference. They both feel exactly the same fear on the inside. It’s what the hero does that makes him a hero” - Cus D’Amato

The above is a quote from the late great boxing trainer Cus D’Amato who was known for training Mike Tyson. Cus was said to be a master of fear. He taught his fighters to become best friends with fear and to understand that it was a normal and healthy part of being alive. If we didn’t have any fear we would be dead. Everyone feels fear, but the difference is what we do with it.

I’ve always found the mental makeup you have to have to be a high level fighter is nearly the same as what you need to be a high level trader. Everyone knows the old wall street adage of “buy when there’s blood in the streets”. But what they don’t tell you is how hard it actually is to do even if you’re an elite investor. They would have you think that the pros have no emotion and can make a trade at the drop of a hat. The reality is, like Cus said, they feel the same fear as the rest of the market participants but what they do is what makes all the difference.

Today, we have a lot of fear being stoked into the markets. Whether it’s, world war three, riots, elections, the impending recession or something else tensions certainly feel like they are high. All of these outside factors make plenty of scenarios we could worry about. However, it’s extremely important to remember that 90% of the things we worry about never come true, and that’s a fact.

Remember the threat of ww3 in 2022? Or the banking crisis low in March of 2023? How about the constant doom and gloom talk of a recession all of 2023 and most of 2024? What about the Israel Hamas conflict that brought about the low in October of 2023? Or the threat of Iran attacking Israel just back on April 13 and 14th?

I’m not saying there are no problems in the world, but to my knowledge the market has not fallen out of the sky due of any of these so called “world ending” events. In fact all of these events brought about a mini panic that gave us a major buying opportunity.

Today, is no different and let me tell you why.

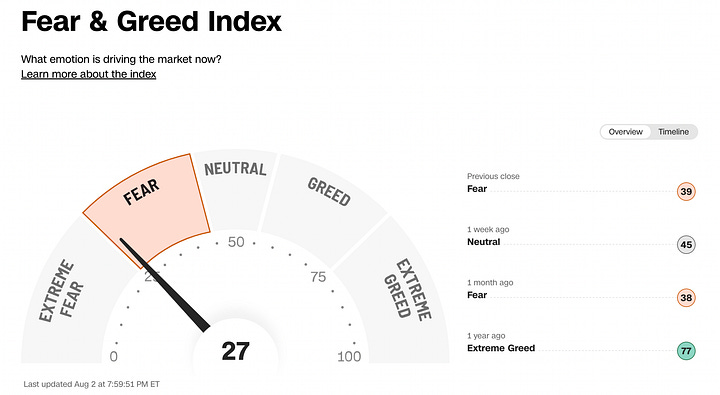

Fear and Greed

For markets that are just off their all time highs there is an overwhelming amount of fear out there. Both the stock market and the crypto market are bordering on extreme fear in their index readings.

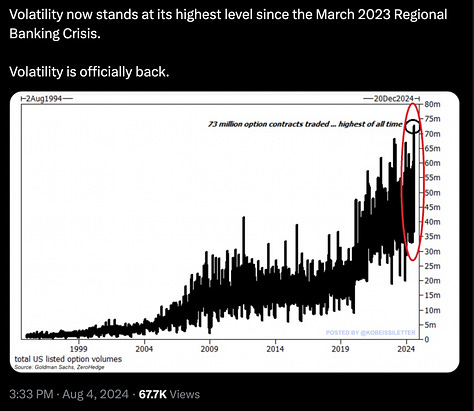

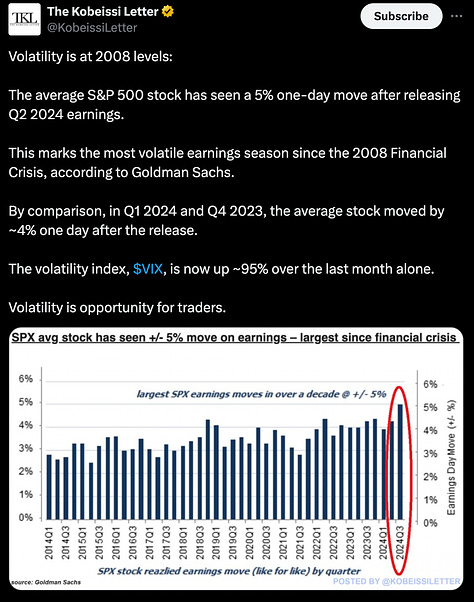

I cannot tell you how many X posts I have seen telling of market statistics that have historically preceded great buying opportunities. Take a look at the below images for just a few I have shared.

Worst day since covid crash?

Volatility at its highest since the 2023 region banking crisis?

Most volatile earnings season since 2008?

Sounds like all out panic to me, yet if we look at the charts and the cycles we are just below all time highs. Something about that doesn’t seem warranted.

Everyone gets fearful at times like this but thats when we have our work to back us up. All the analysis that we did when these emotions were not present told us to look for a major August low. Now that we are here and everyone is panicking we are not going to throw all that out the window. It’s the foundation that allows us to see this for what it is while others panic.

I have gone over cycle after cycle to find out where or how we could be wrong but I just can’t seem to justify an all out collapse here. Let’s take a look at the charts to see what I mean.

Stocks

I’m going to try and keep this one relatively simple. If something isn’t broken then don’t fix it. That’s what our 60 year cycle is telling us. It has been working well all year and we are continuing to track it.

August 5th, which is today, is the day that the market made a low 60 years ago after a 50% retrace of the previous move. I had been saying since the 17th that this correction had more downside. Even after the historic 6 or 7 percent day whatever it was I wrote to premium subscribers and told them this market would make a new low. It did exactly that on Friday.

However, we are now getting to the point where time for this panic may be running thin. Below is the plan I laid out in last weeks market outlook versus how it played out.

This is a very typical correction window for stocks in election years. That said there is the possibility of a rally into September and then more downside into October. But we will get to that when it comes. For now, at the very least I expect the stock market to start forming a bottom. It may not fully cooperate until later in the month so don’t all out long but I am saying to start looking for our typical bottom signals. Reversal candles, bullish RSI reversal, 3 day reversals etc. Let the market tell us that the bottom is in.

Here is the weekly perspective going all the way back to this time last year. This is the 3rd three week correction that has given us a 6% drop. As you can see what I’m saying that it remains to be seen how strong the rally is from here. That will determine if this is the low or if we have a longer drawn out correction into October like we did a year ago.

Lastly, the dates I have to watch here are August 8th which is a Gann natural date. And then I have the 16th of August as 120 degrees from the April low which is the low of the year.

Bitcoin

Bitcoin is pulling out all the stops to try and catch everyone offsides. Luckily for us we have been eyeing this moment as a buying opportunity since the beginning of May. I have been laying out this plan for weeks so if you have not read the other reports you may want to do so here and here to further your understanding of why a major low is likely in this time window.

As I said, when things start to get chaotic we have to stick to our plan that was laid out without all the emotions. Although this has been an extremely tough move to navigate I am going to tell you why I believe this is going to mark a major cycle low in BTC.

Take a minute to watch the video below to see what I mean.

These daily time by degree dates have been a strong indicator of changes in trend and when we get so many clustered together it can be a powerful signal. When you pair that with the higher time frames that we have laid out in previous reports you get a major changes in trend. In this case we have the 90 week and 20 month window working for us in conjunction with our daily time frame analysis.

The dates to watch this week will be around the 6-9th specifically. And remember the Gann natural date falls in there as well on August 8th.

Conclusion

These environments are not easy, but the best of the best learn how to thrive on this level of fear. We have called every major low of this market so far and I am confident time and our analysis will prove right again. Remember, we have been planning this low for over 3 months and now it’s time to step up and execute. I am not telling you to be a hero and do something ridiculously risky but I am telling you to ignore the 95% of participants that will always be on the wrong side of the trade.

As for specifics, I think stocks will struggle to find footing for a few more weeks even if the low is this week. Same thing for crypto. I like the chances of a major low here in the coming days to be confirmed but after such a wipe out the market usually needs some time to get sorted out. We then have the strong seasonality coming into play towards October. I believe we will look back on these prices of crypto in 3 months as an absolute steal. Moments like these can make or break your entire year so learn to make fear your best friend.

There is nothing easy about this job at all, so chapeau, what a great job you've done. You have been spot on for months now. Lucky for us we found you.