This week’s portfolio update highlights key trends in Bitcoin and Ethereum while providing insights into potential altcoin opportunities.

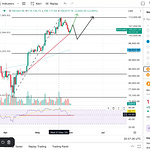

Bitcoin remains range-bound despite recent volatility, with the market awaiting a breakout above recent highs or a drop below support levels to signal the next major move.

Historically, similar patterns around early December have indicated potential for either consolidation or correction before significant trends emerge. Ethereum, however, shows stronger momentum, breaking past the $4,000 level and eyeing a potential surge to $6,000 in the coming weeks, driven by long-term bullish trends and growing market confidence.

Additionally, we emphasize strategic positioning in altcoins, particularly those with potential for explosive growth.

Just this week we had our second biggest winner in MOG, get a CEX listing on Coinbase bringing long time readers to an 85x on that position.

The focus remains on identifying sleeper picks, which show resilience and align with emerging market narratives. Timing and patience are crucial, as the market will reward holders during high-volatility periods, where rapid price swings can lead to 5x or 10x gains within days.

Finally, we underscore the importance of holding through volatility and recognizing long-term accumulation zones. Any correction phase now offers opportunities for accumulation.

As market conditions continue to build up for a breakout, staying invested and understanding where we are in this alt coin market will be the key to maximum upside potential.