Market Cool Down: Key Buying Opportunities Ahead for Stocks and Crypto

The markets finally managed to cool off after a big shift in sentiment last week.

Stocks are correcting into that early June window we have been highlighting as a potential buying opportunity.

In the short term the SPY continues to lose ground slipping below the 25% retracement level in black. It also just finished a 3 day reversal in time and we had the signal candle last week that we talked about.

So there’s still room to the downside here. I will be watching late next week or the following week for a low. The question is if the market will take out the previous lows from April similar to what it did in the 60 year cycle.

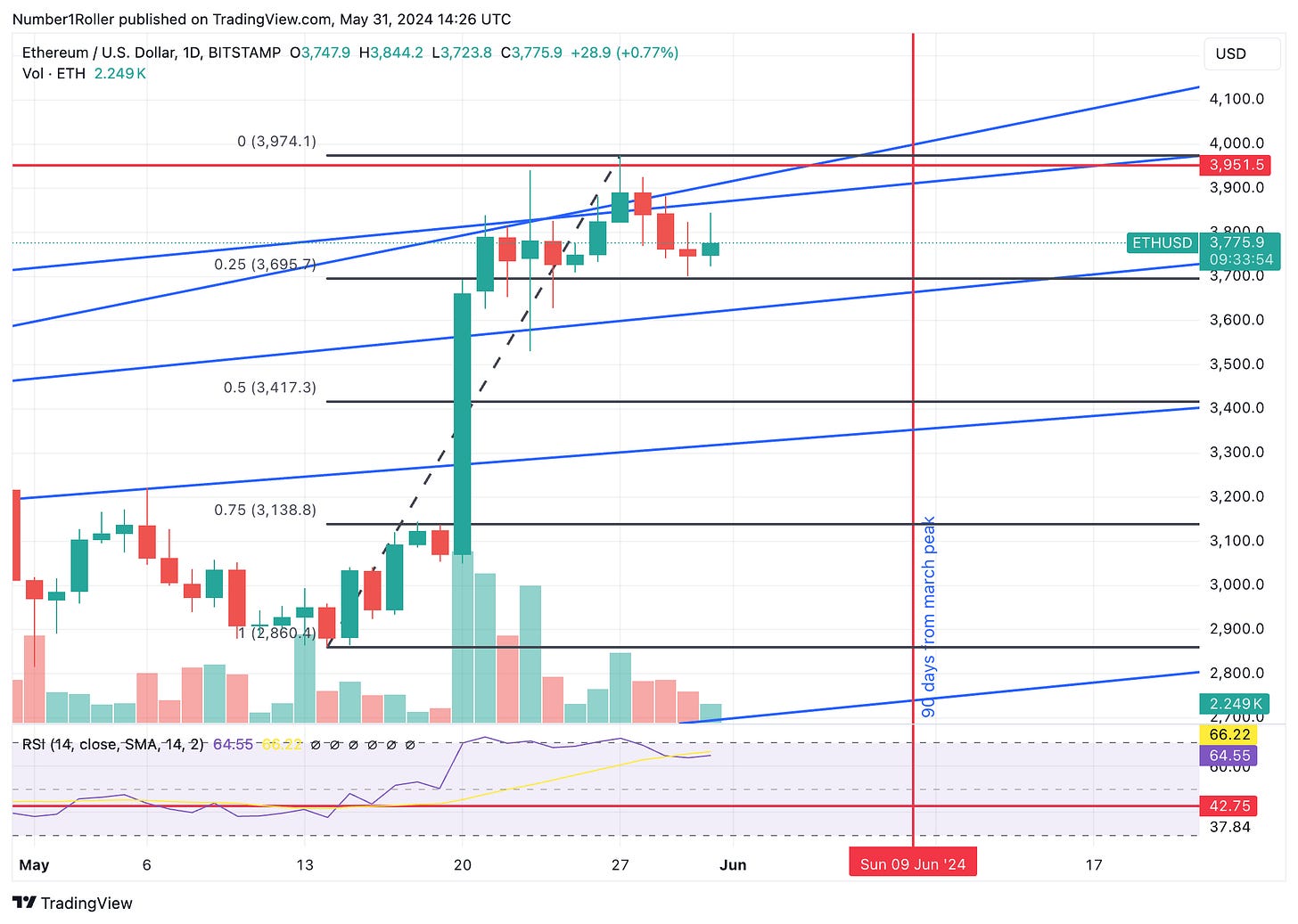

As for crypto, the choppiness continues. No real selloff here like in equities but the majors have slowed down.

BTC looks like it’s in a clear accumulation zone on high time frame. On the low time frame, higher highs and higher lows nothing concerns me here. I imagine we could get slightly more downside since we have broken a few short term supports but the next run will likely take us to new highs in a few weeks time.

ETH also managed to get a three day reversal in but was able to hold above the 25% level meaning that we are still strong in price here but time may give us a longer consolidation here before we move up.

All in all positioning remains the same. Be patient on the market and watch for late next week for it to start turning around. There’s not much to do here since most of our portfolio is strong ETH beta plays. Just observe strength and buy coins that ran the hardest in the last few days but are now on a pull back.