Markets Face Key Inflection Point as Federal Reserve Meeting Looms: Market Correction or Crash Ahead?

It’s been a tough 3 months for equities as they have continued to break down through several important levels. The decline has tested even the most bullish investor’s confidence.

This week have the Federal Reserve meeting this Wednesday November 1st, where they will make the next decision on interest rates. Looking back at the year this has market some key inflection points and I expect this one to be no different.

While things have gotten a bit more extended than we would have liked from a price and time perspective I believe we are still looking at a market correction here and not a crash.

This is the S&P 500 weekly chart. I have marked all the Fed meetings this year with vertical blue lines. These clearly marked several key inflection points in the market. With the way price is trading into this November first meeting I would expect a low within a day or two of that.

We have the .618 Fib level coming in play from the March low. We also have a major bullish rsi reversal setup on the weekly. Lastly, this corrective wave has lasted 14 weeks and given a drawdown of nearly 11% which tells me from a price and time perspective we are overextended. If this is in fact a correction and not a crash we should see at least a 2-4 weeks up from here, if not a full on rally to new highs.

Looking at the Dollar.

Again, I believe the dollar has topped but it is not wanting to give us a substantial decline yet. Likely, due to the war concerns. People usually flee to the dollar as a safe haven it times of turmoil. However, it has been putting in a bearish rsi divergence here and is unable to break back above the highs. The fed decision will also be key factor for dollar strength.

Lastly Crypto

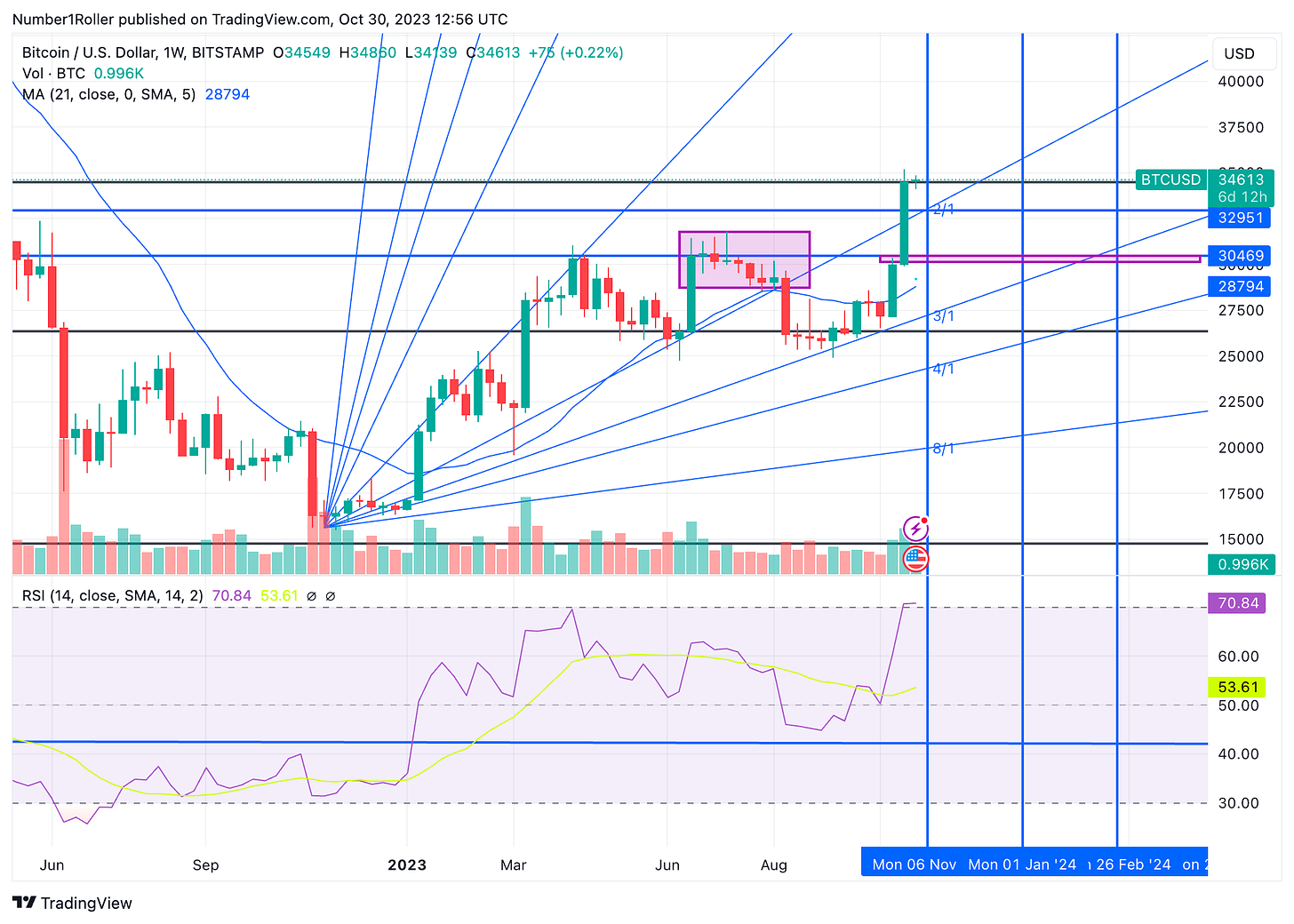

Here is the weekly BTC chart. It closed last week right on a major level around $34,500. This is the all time .50 percent Fib level and its showing its importance. If we can break out above this level this week our next spot to beat will be $36,000, above that we could see low 40’s. However, we are watching the second week of November as key inflection point so we want to remain cautious of how much longer this rally has on the long side before it takes a break.