Today marks June 21 and the official start of summer. The past week has felt to me like a bear market as I’m sure many of you have been feeling the same way. Yes prices are down in crypto but it has more so felt like a bear market in the sense that things are extremely boring.

However, given the change in seasons and the Gann time factors we are working with I think all that is about to change soon. If you did not get a chance to watch our Wednesday update I recommend you do so here.

Otherwise let’s just jump right into it as my feelings have not changed.

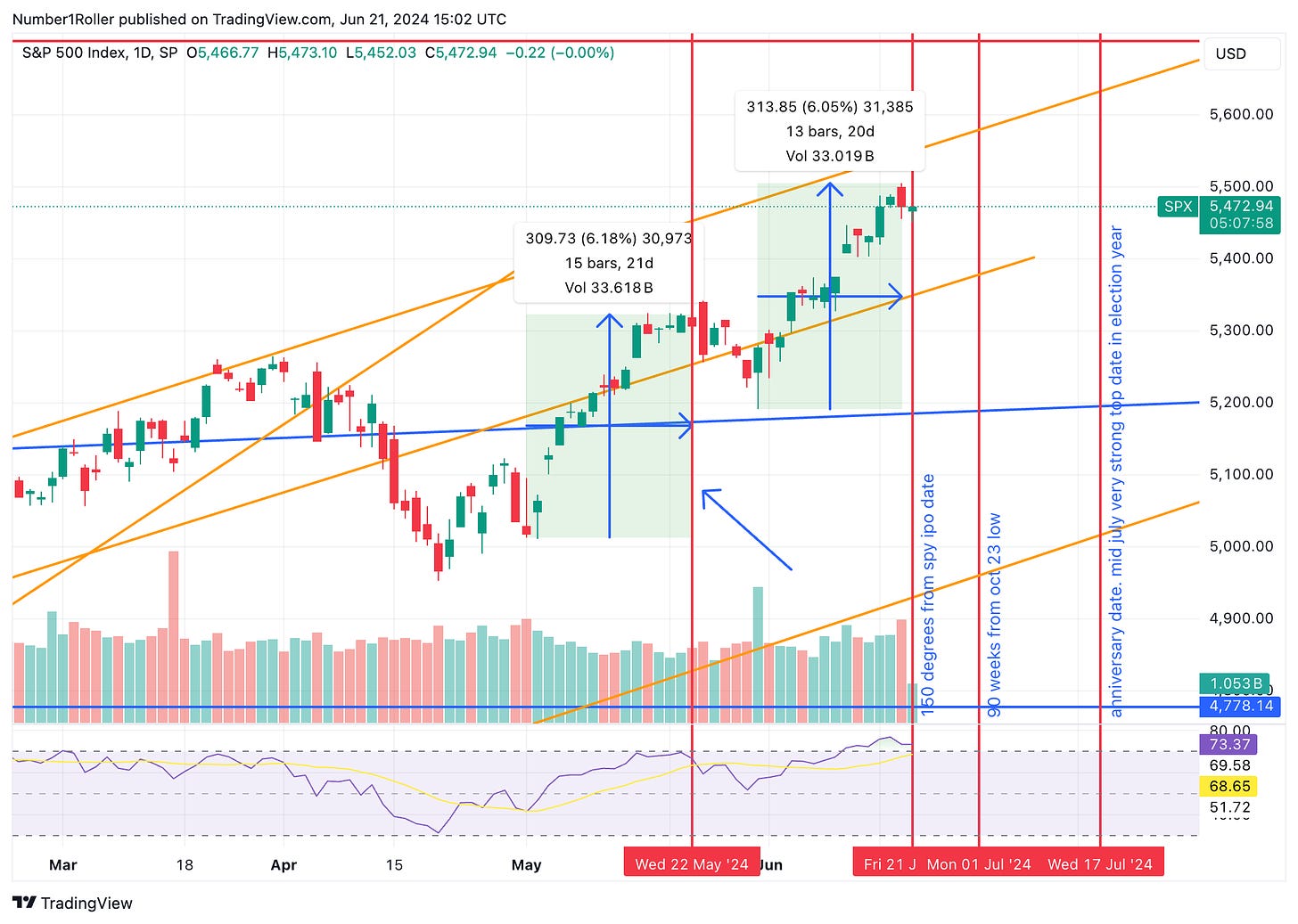

First, looking at the stock market.

Be ready for a pullback to buy here. As you can see we have two symmetrical moves up. Each move was 20 calendar days (not trading days) and exactly 310 points. So two symmetrical moves in time and price are coinciding with the red line which marks the 150 degree date from the SPY IPO. The red line with the arrow pointing to it marks the last time by degrees date which was also a short term high as you can see.

We also have a lot of people noting that the RSI on QQQ is at historically high levels.

So, all this is coinciding with our natural date of the summer solstice. That tells us be ready for a change in trend. The good news is that our seasonality of the election cycle still tells us the market has more room to the upside as does the above graphic. We also have our next natural date on July 7 which falls on a Sunday but would perfectly align with the previous 10 day correction putting a possible low ( if we correct here) around our next natural date.

As for crypto the setup in nearly the exact same but just opposite.

Again, we have our natural date tomorrow and it’s coinciding with price here. Notice the daily rsi in the orange circles and how these levels have been marking the lows. We also have a bullish reversal setup if you look at the blue arrows, price is making a higher low yet the RSI is making a lower low. That tells us that BTC is too oversold here in the short term. Add in the fact that the price is sitting right at the intersection of the green 1/1 line up and the black 1/1 down while coming into our date and I would say that this has the recipe for a significant low at least in the short term.

ETH on the other hand is holding up much stronger than BTC

Again, I encourage you to watch the Wednesday video where I talk about signals and time. As you can see here we are holding up better than BTC and still holding that 3 day reversal in time. So if this market gets going expect ETH to outperform.

Lastly, a quick teaching point from last week.

Last week I demonstrated on a few meme charts what to look for in a bottom.

Below is TRUMP from last week vs. how it played out

So you see, many meme charts look like this. The point is when a chart makes a lower high and then a lower low there is going to be a panic 100%. So never buy on the second bounce and sell out if it takes out the low from the first correction. The other point is WAIT to buy until the 3 legs down completes. THEN look for a SIGNAL CANDLE.

Here’s another great example. CHOMP the current leading meme on BASE.

I can nearly guarantee you this retests .25c level. It broke down, made a lower high, and then a lower low. THERE IS GOING TO BE A PANIC. That is when you buy.

This is important to keep in mind because a lot of charts look like this and a lot of people constantly try to guess and knife catch a bottom. Forget it. Bottoms are actually much easier to spot if you know this. Wait for the three legs down ad then wait for a signal candle. Boom you now have a much much safer way to buy the lows. Stop guessing.

So, while I am optimistic about relief in the coming days/weeks be weary of buying a chart like this. TRUMP will be a great one to study because of the coming debate. To me it looks like it needs one final leg down so the key will be to watch if it can’t make a higher high in the coming week leading to the debate, if it doesn’t there will be a panic to buy.

It’s that simple, on alts that have been bleeding for weeks, zoom out to a weekly chart look for the 3 leg down structure and then a signal candle on the weekly. Those will be much safer to buy then trying to knife catch chomp.

All in all I expect that we are on the precipice of a turning point here. Be ready for relief but don’t bet the house on it. We still remain in a very tough and choppy market and could potentially be so until August.