Today’s alt coin pick sits squarely at the intersection of two of this cycles biggest narratives, Real World Assets (RWA) and real estate.

This token has one of the strongest charts in all of crypto and in fact never went into a bear market in 2022. At such a small market cap with such strong insider buying this small alt coin has the potential to be the biggest sleeper in the entire RWA sector.

Long time readers know that the linchpin of our cycle study is the 18.6 year real estate cycle which is coming to a head in 2026. This is where we see massive credit creation culminate in a land boom the likes of which we have never seen.

This cycle is the core driver of asset prices as all economic rent must accrue to the land.

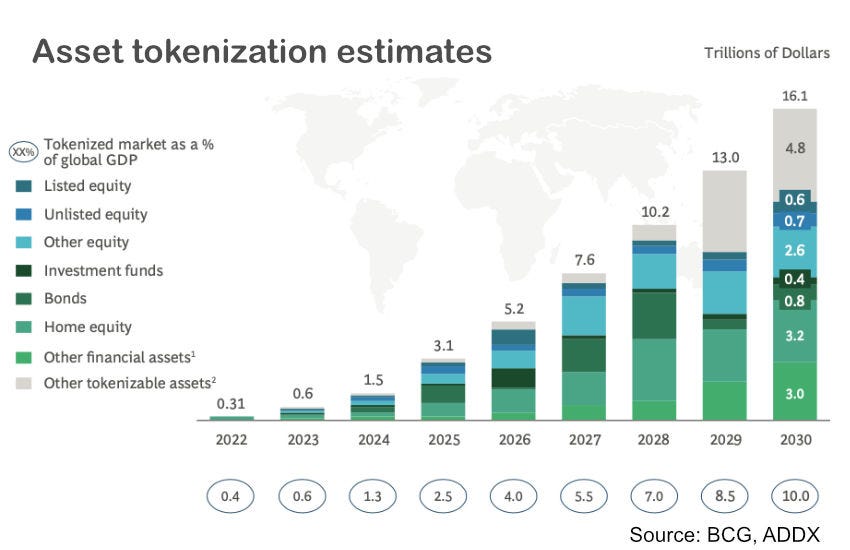

At the same time, we are seeing a new and emerging sector of crypto known as real world assets. This is a sector that is tokenizing things such as tbills, cars, carbon credits, securities, and real estate.

So you can see how this would be the perfect sector to get very hot on the heels of a speculative mania towards a real estate peak.

In fact at the beginning of 2024 this was one of the fastest growing sectors of crypto by market cap.

From the beginning of 2023 to the end of 2023 this sector gained 6.3 billion dollars of market cap which is great growth but still a very small fraction of its potential.

The graphic below from Boston Consulting Group estimates that this sector alone could be worth nearly 16 trillion dollars by 2030. Thats over 100x from todays valuations.

While real estate is the largest asset by market cap in the world its not only about real estate.

Since the advent of the crypto ETFs in 2024 traditional finance institutions have taken a huge interest in this space. Larry Fink, the head of Blackrock, the largest asset manager in the world, has publicly stated that all securities will eventually be tokenized.

For a long time tradfi dismissed crypto as a useless technology but the emergence of ETFs and tokenizing real world assets on chain has brought them to a new understanding. It’s given them a sector that they actually get and can see the value in.

Thats huge because not only do we have a major cycle combining with a major narrative, but we have big money wanting in on it.

Today we are going to be adding a project that has been in the works since 2018. They focus specifically on tokenization of real estate and are fully operational. They have pioneered this sector by being the first to tokenize real estate in several countries around the globe. But,unlike many of the new RWA protocols they have passed regulatory hurdles which is the biggest barrier to entry in this space and can often take years.

As this sector starts to shine again in 2025 this will be a huge winner. I expect we could see 20-50x returns given the fundamentals and small market cap of this project being overlooked.