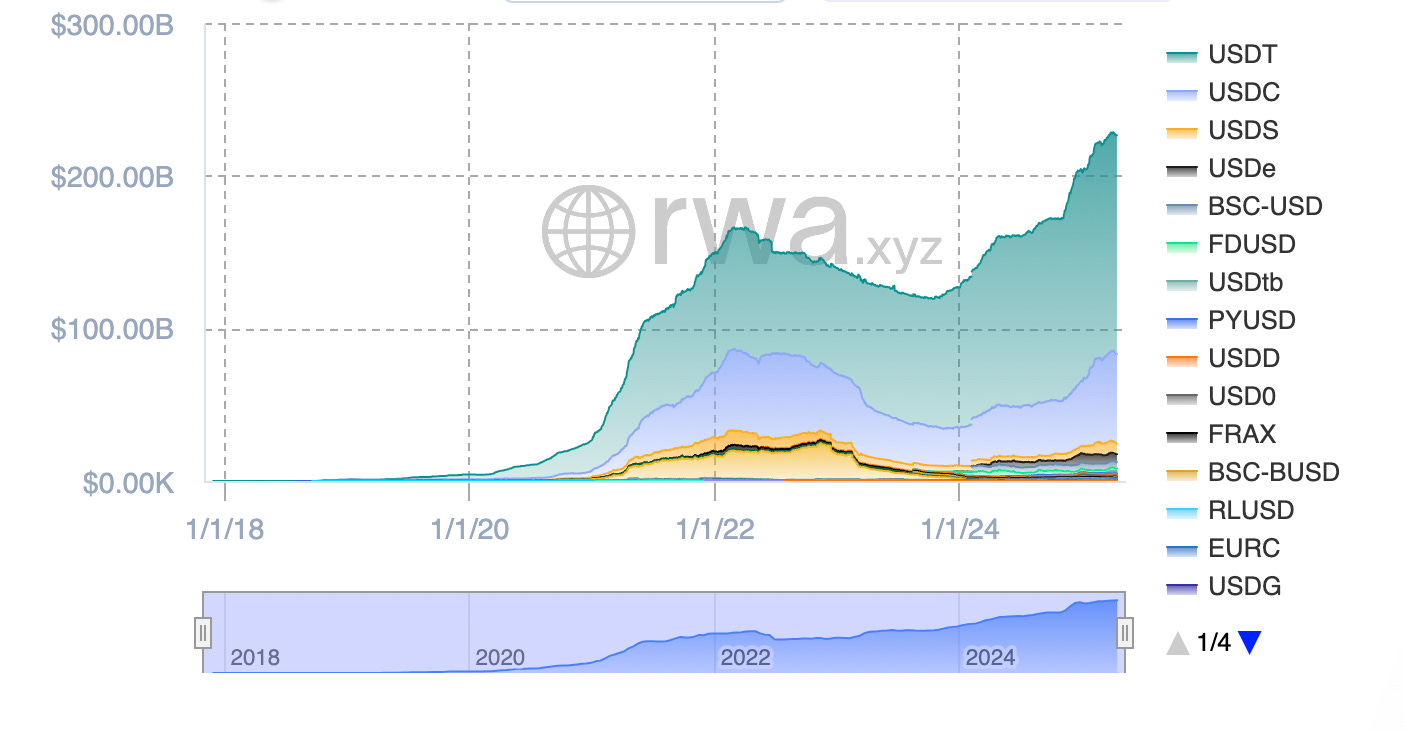

Stablecoins have become a massive topic in today’s market — and for good reason. The market cap has exploded over 100x since 2020. What started as a niche use case is now one of the most important sectors in all of crypto.

And now, the U.S. government is taking note. They're waking up to the idea that stablecoins might actually help secure dollar dominance for decades to come — by bridging the gap between traditional finance and this new digital financial system.

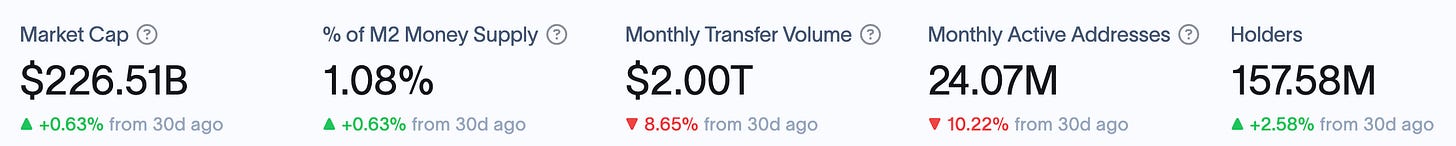

We’re talking about $2 trillion in monthly transfer volume and close to 160 million stablecoin holders globally. That’s no longer a small corner of DeFi — that’s the next monetary base layer being built in real time.

And now we’re getting real regulatory frameworks being proposed. The rails are being laid. The capital is coming.

But here’s the big question:

How do we actually capture this upside as investors?

How do you invest in something that, by definition, is supposed to be “stable”?

That’s what I want to talk about today — because there’s one protocol I believe has been building for this exact moment. A project that doesn’t just aim to grow with the stablecoin sector — it aims to transform it entirely.