Weekly Market Outlook: Balancing the Waves of Time and Sentiment

Last week was relatively calm, crypto and stocks continued to grind. We have been exercising a lot of patience in this market and this week will be no different while the market is between a set of time factors. The most important economic data this week will be jobs at the end of the week which align with a minor time factor for stocks on April 4.

Otherwise, nothing too significant concerns us but it’s notable that our AAII sentiment survey took a big jump in bullishness last week from 43% to 50%. One of the main reasons we have been so bullish through this stock market and crypto run is because the overall lack of bullishness by market participants. So when that turns into extreme greed (upper 50% range) we will know the run may be coming to an end as late comers pile in.

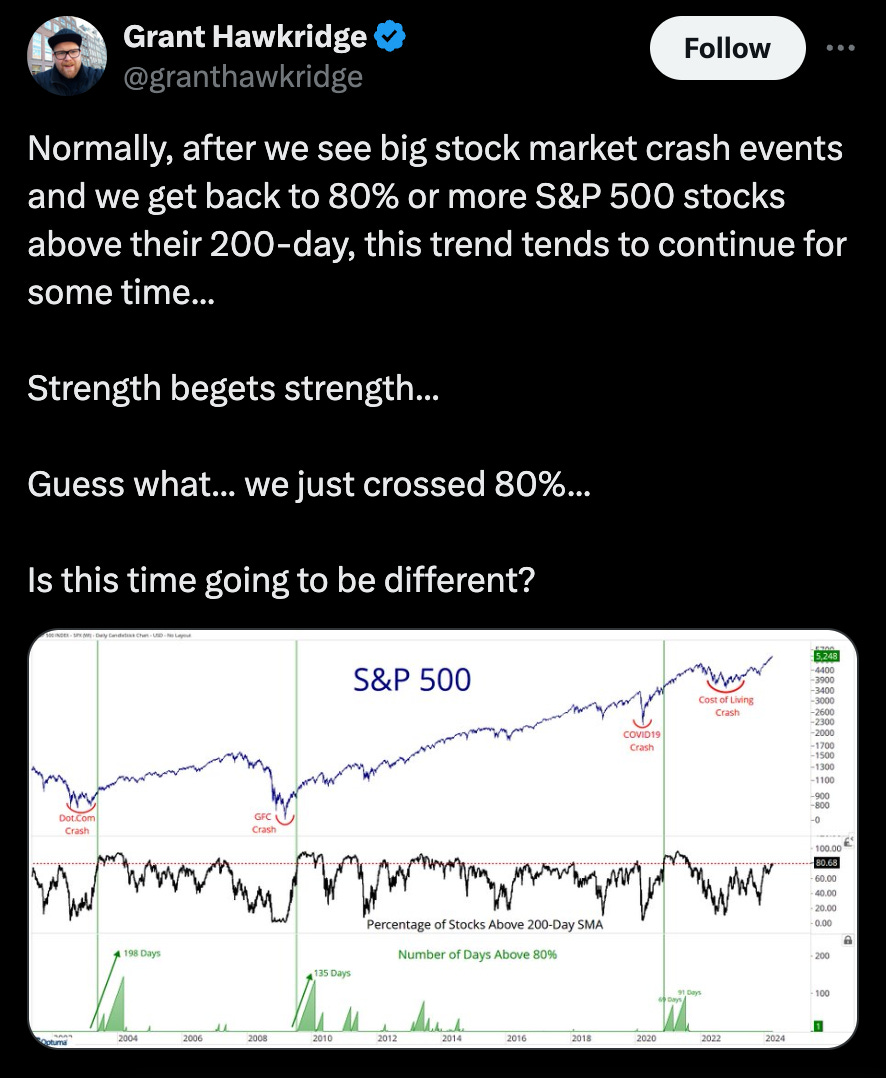

On top of our cycle analysis and Gann analysis where we talk a lot about following the trend of the market, let’s look at some data that backs this up.

As we mentioned last week, more stocks hit new 52 week highs that at any point over the previous 12 months. This says the market breadth is actually getting stronger not weaker. Regardless if you think 2022 was a crash or a correction, in the post above the point is that when stocks recover to a strong position they usually continue that strength.

Additionally, when stocks have been bullish from December through March, April has been a positive month 82% of the time with the rest of the year coming in higher at a 100% hit rate since 1950. Pretty strong data that tells us April will favor continuation of this trend.

Lastly, if we take a look at the S&P updated 2024 cycle from @IntrdadayCycles on X we can see that the next major peak in time is coming in that early May window we have been cautioning you about for some time.