Weekly Market Outlook: Inflation Back in Focus

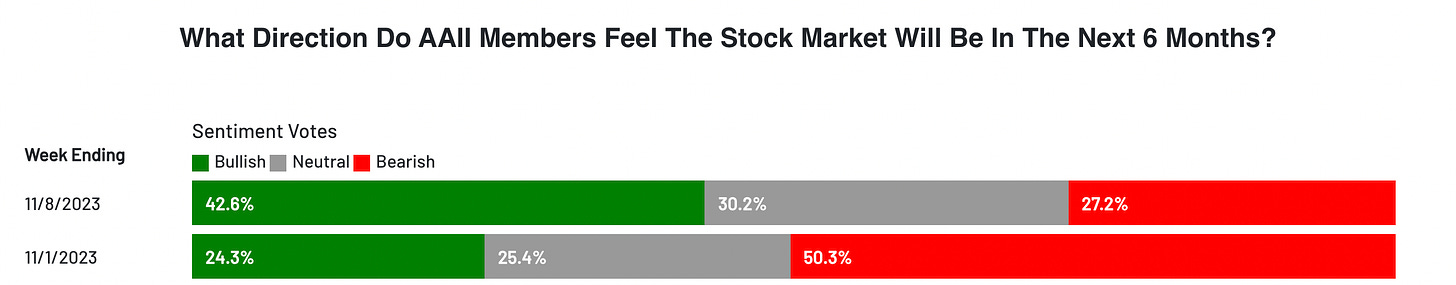

Over the last two weeks we have experienced an extreme sentiment swing in markets with participants going from overly bearish to overly bullish. The price action has reflected this by acting like a beachball that was held underwater. You can see this shift in the American Association of Individual Investors weekly sentiment poll.

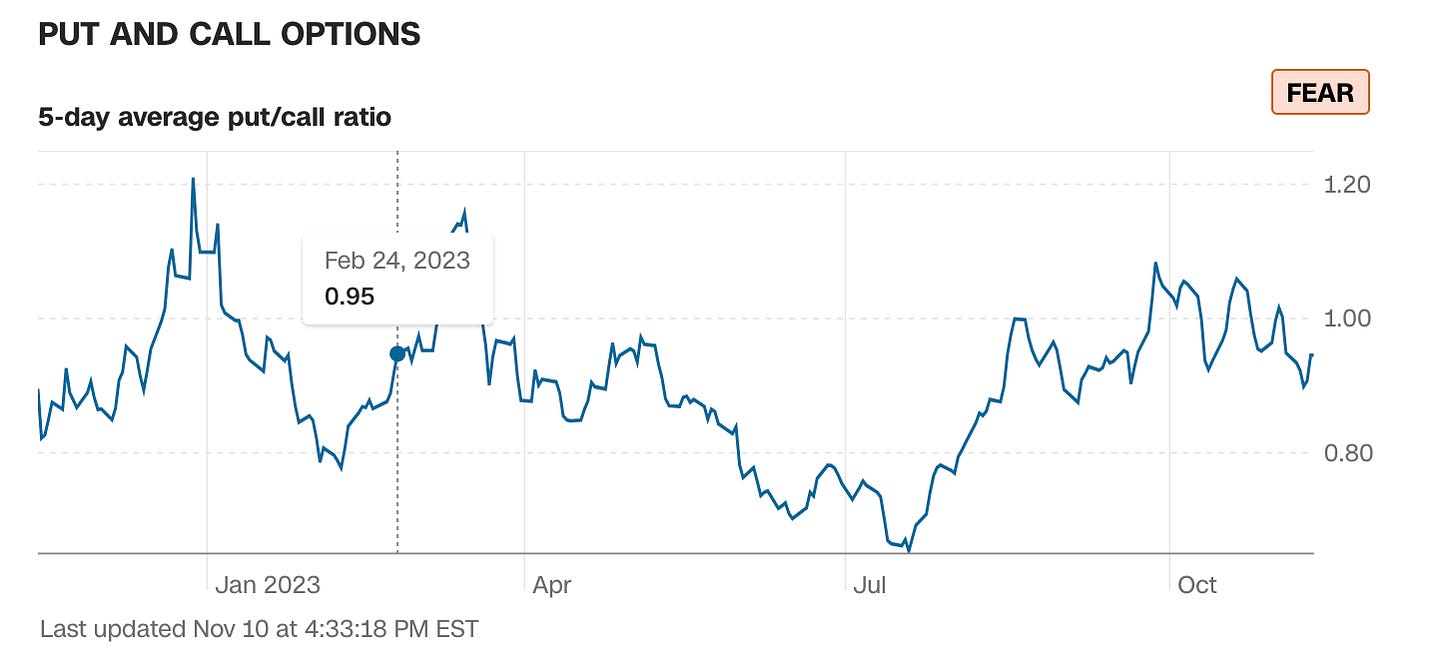

Historically, when either side of this poll crosses into the 50s we are close to getting a move in the opposite direction. However, if we take it a step further we can look at the fear and greed index and see that the market is still relatively fearful here as positioning shows that people are overly short this rally.

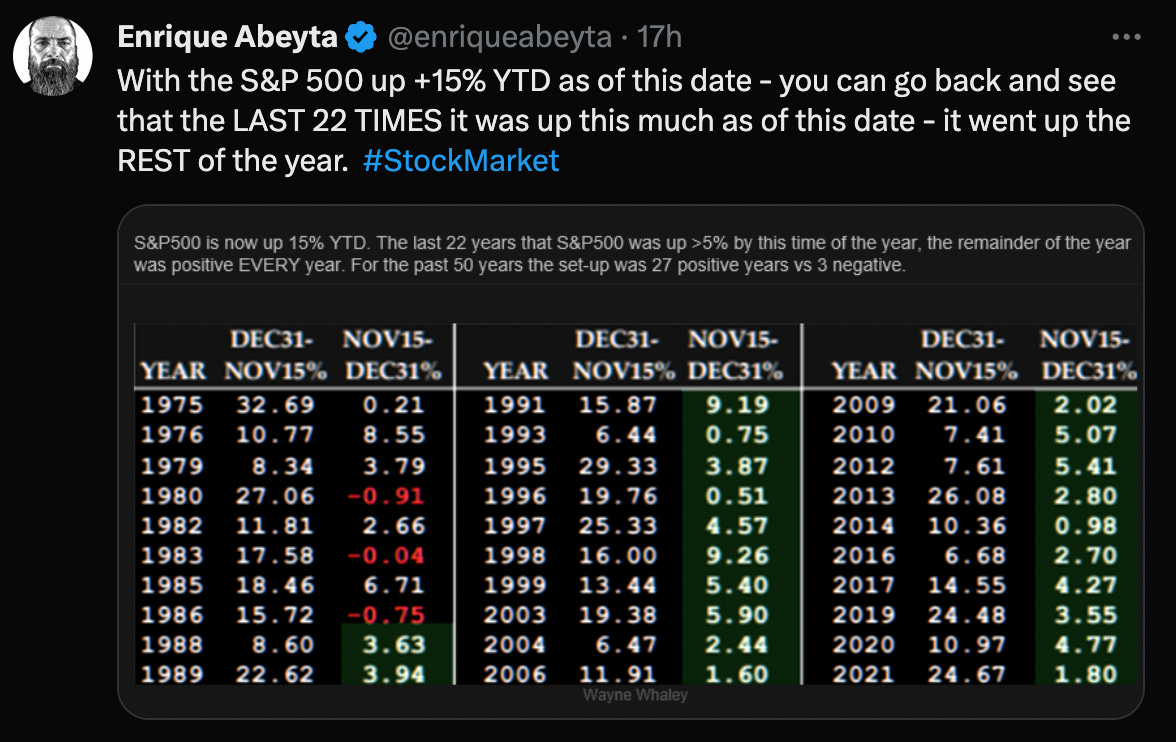

Positioning is important especially as we go into year end. With the market sitting up 15% large funds will need to show clients that they had a huge year. However, lots of these funds were sidelined for the summer rally and are now needing to make up for lost time. Historically, this is what can fuel a year end rally and that is exactly what we we have seen in the past in this scenario.

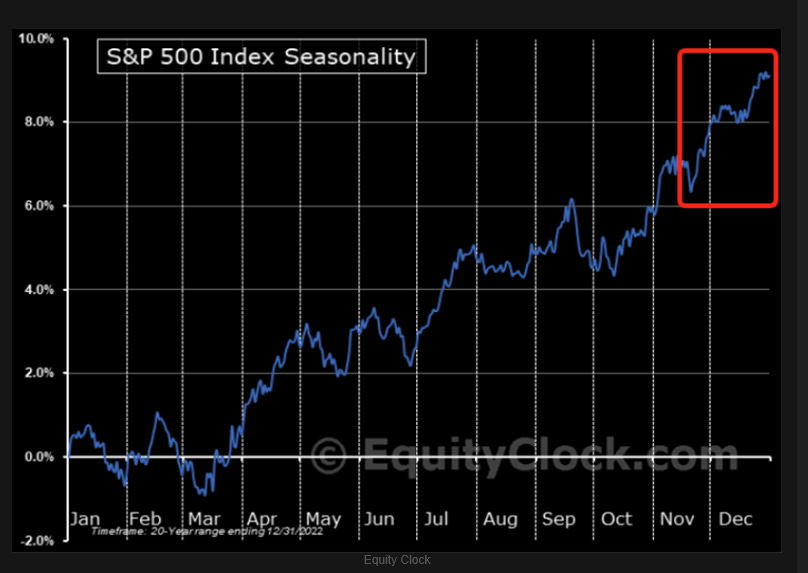

We also have seasonality on our side.

The biggest data point in focus this week will be inflation data. CPI comes out Tuesday and after a recent spike all eyes will be on the number as investors look for clues of what the market may do next. Remember, the market is a forward looking indicator so the number is likely already being priced in. Unless its a big surprise to the upside I don’t expect it to be anything that will topple this rally.

Let’s look at the S&P

Here we can see price closed right at the double black lines which is a big level. We also closed above the Aug. 18 low and above the October highs which is a good sign. I wouldn’t be surprised to see a pullback this week but again, I would expect it to be short lived and shallow and an opportunity to buy.

Same thing with the Nasdaq

Nasdaq is also at a key level but it is even stronger than the S&P as it has been all year. Again, pullbacks are for buying here.

Looking at the Dollar

This one has been tough as the DXY just doesn’t want to go down. Inflation data will likely be key in which direction the dollar goes. Right now its back above the key level with the two black lines but its struggling to get above it’s 21 day moving average so we will have to see which way it chooses this week.

Now turning to crypto here’s the Bitcoin chart