Weekly Market Outlook: Stick to the Plan

Continuing to stick to our plan this week. As I mentioned the last few weeks, the first part of December could be relatively boring for stocks. So far we are seeing that with indexes chopping around to start the month. Stocks still have not managed to produce any meaningful selloff as we said dips would be short and shallow.

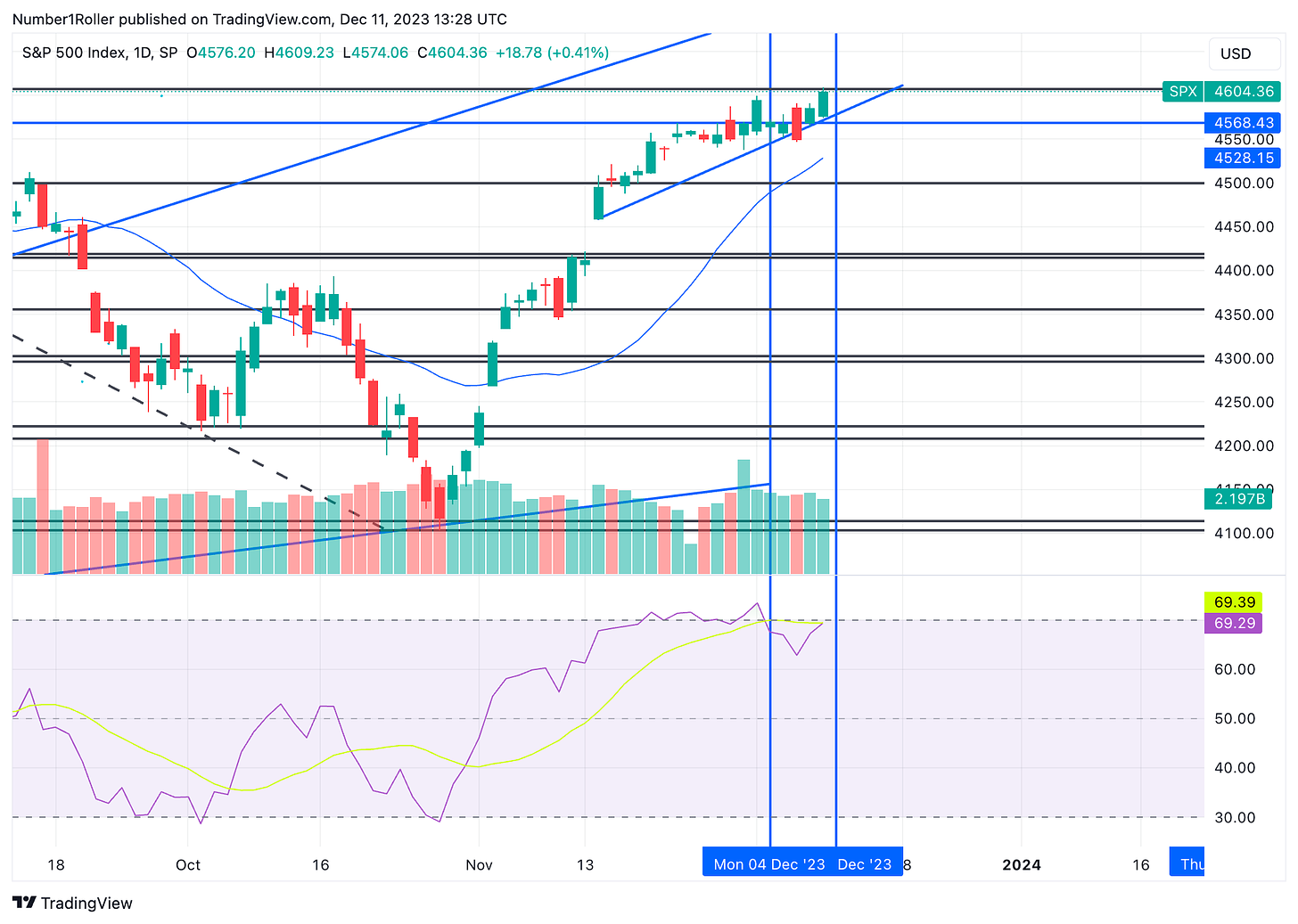

Here’s a look at what I’m watching in the S&P500. The index has managed to hold the short term trend line and make what could be a low right in the middle of an important time window marked by the blue vertical lines. We are currently knocking on the door of new yearly highs, something the DOW has already achieved.

This week we will have inflation numbers coming out so expect some volatility early on. It’s possible the market makes one more low into the middle of this week but I expect it will catch up to the DOW and start pushing above yearly highs aiming for the all time high by the end of the month.

As for crypto, it’s also more of the same. If you missed our midweek report last week you are going to want to read it here. In it I talked about the potential for a short term top to come in right in our window and that is exactly what we have gotten so far. I also want to reiterate that I do not see a -30% style drawdown yet. We know those are typical in bull markets and we have to respect the volatile aspect of crypto which I think a lot of people are not doing right now. That being said we still stick to our plan.