Time for the week everyone has been waiting for. The US presidential election will take place tomorrow and then on Thursday we will have a FOMC interest rate meeting.

As always when we get around elections markets like to get volatile and fool people into thinking that this time is actually different and the election does matter.

The outcome will drastically impact the price of assets across the board.

If Kamala wins it’s over and we will be in a decade long bear market. If Trump wins we will have the melt up of a lifetime.

These two statements couldn’t be further from the truth. It’s funny seeing people get so worked up on X saying that Trump has to win in order to save the markets.

But somehow it’s lost on people that bidenomics with Harris at the right hand side has given us record high asset prices across the board.

So tell me again how bad the Democrats are for the market?

It’s a completely baseless claim and shows you how much some of these people really know about the market.

As long as the government continues to spend and rack up debt the cycle will chug on no matter who is in office.

Whatever the outcome may be, the immediate impact of the election is likely to be short lived. It’s the public that is buying or selling the news and they will be wrong ten times out of ten.

Look at the 2016 election where Trump delivered, arguably, one of the biggest surprises in US election history when he won. According to the experts it was supposed to be armageddon and down for the rest of history.

What actually happened? The market immediately sold off for two to three days and then took off.

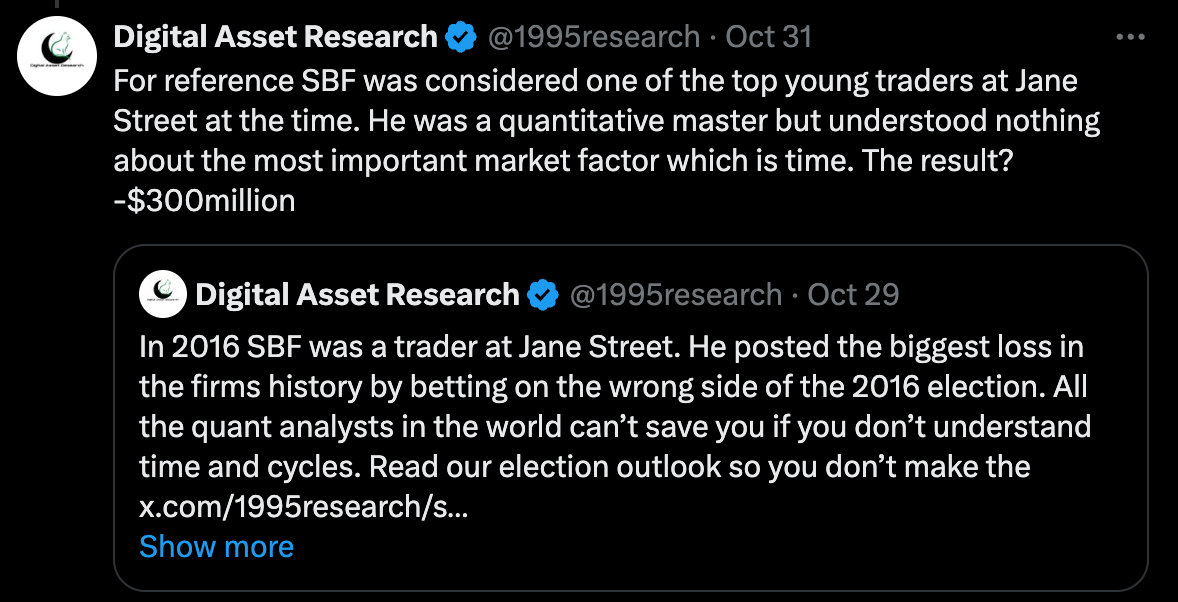

To drive the point home I shared this post on X last week. Here we had the prodigal son SBF in all his smarts short that election low to the tune of $300 million. Of course, Wall Street knew Trump was a disaster for the market. So much so that they took it in the shorts on all their quant models.

Could we see a similar setup with a Harris win?

I’m not a Harris supporter by any means I’m just making a point that there wont be an imminent market crash if Harris were to win.

Markets love the Trump trade right now and are scared of Harris’ policies. I imagine Wall Street would once again be in a panic were she to win, only to find out days later that were in a bull market.

But, elections aside lets turn our focus to what really matters.

I have talked extensively about this probability of a grinding market given what we saw in 2012 and 2016 and our setup today mirroring those cycles closer than the 2020 cycle.

Keeping it simple this week we are sitting at another critical time by degrees date. It just so happens to fall on election week but you can see how time has preordained this news.

Looking at the weekly chart you can see we are 30, 60 and 90 weeks from key weekly inflection points of this current cycle. 90 weeks ago we had a weekly swing high that signaled the banking panic. 60 weeks ago we hit the low of the 2023 summer range. And 30 weeks ago we hit a very emotional before cascading on middle east tensions.

We then have the confluence of the daily cycle within the weekly. Below you can see how well time by degrees has been working with consistent major turn dates early in the month. As I write this today on November 3rd we are 90 degrees from the August low.

Finally, these important time factors are aligning with a bullish RSI reversal right on a backtest of the breakout zone. Shown below on multiple time frames the 1,2, and 3 day charts. All bullish

The last thing I want to leave you with is an update to the BTC vs NVDA fractal that I have been sharing for a few months now. Not only is it nearly perfectly on track but it serves as a good reminder to what a true expansion in BTC will look. Even in the fractal it would suggest that the final two months will be a gradual climb and then a much bigger move starting in December going into 2025.

So, don’t get caught up in election nonsense. Anyone that thinks Harris is bad for the markets ask them why then are we currently at record levels. Anyone that thinks Trump will save the market ask them what markets exactly need saving.

Time is the most important factor the cycle will roll on regardless of any one man or woman. We are still in a firm bull trend making higher highs and higher lows. The current correction is looking to reverse on time rules and bullish technicals this week. The market will test your patience and conviction over and over again don’t fall victim to the short term noise.

Now’s the time to join as a premium subscriber. Low-cap alts are primed for upside, and our latest pick soared 200% in a week. Don’t miss out—position yourself for the next big move.